Educating Sommeliers Worldwide.

By Beverage Trade Network

The 2025 Wine Industry Report was just released on January 23, 2025. Authored by Rob McMillan at Silicon Valley Bank, it offers a compelling overview of the trends shaping the global wine market and highlights key areas of growth and challenge for the on-trade sector and sommeliers. Sommelier Business breaks down the report, with an analysis of points critical for wine directors and floor sommeliers.

With shifting consumer preferences, post-pandemic recovery, and the ongoing push for sustainability and innovation, this year’s report delivers actionable insights for professionals at every level of the hospitality and wine industries.

The on-trade sector, which encompasses restaurants, bars, and other venues where wine is consumed on-site, continues to recover from the disruptions of recent years. However, the 2025 report reveals that this recovery is uneven, with notable regional variations. Markets in North America and parts of Europe have seen a return to pre-pandemic spending levels, while others, particularly in Asia, are still grappling with slower recovery rates due to changing dining habits and lingering economic challenges.

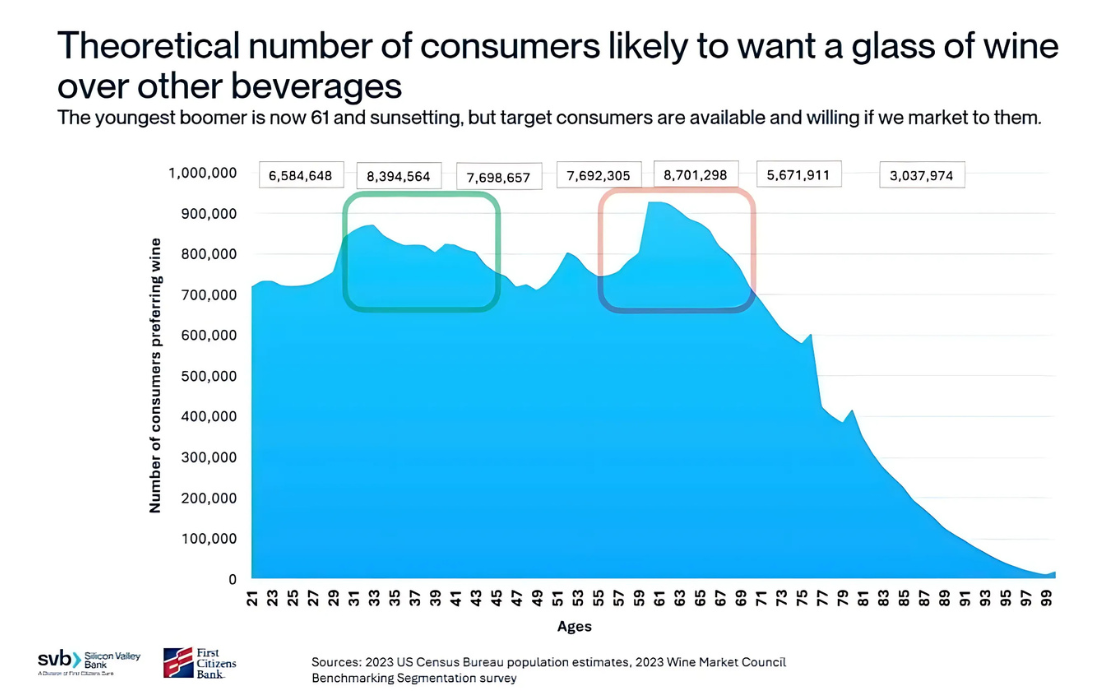

The report emphasizes that on-trade venues must adapt to evolving customer expectations. Demographics are critical. Rob McMillan states: “You should notice the large population of consumers with a wine preference in the 60-69 band and the speed at which the population drops by year after age 69. This is still the dominant consumer group, but it’s getting close to the next most prominent band at ages 31-39. Those older consumers will continue to drink less as they age. . . . The loss in the +60 band will be offset by new LDA consumers between ages 21 – 29. They will reach the legal drinking age at a rate of 4.4 million annually.”

The report emphasizes: “The 31-49 age band is the opportunity set. If we can market to convert the occasions when that band of consumers prefers wine instead of another choice, we can slow or change” the current declining trend. How do we do that?

Diners increasingly prioritize unique experiences, and wine lists are no exception. Sommeliers and beverage directors are tasked with crafting programs that balance familiarity with discovery, offering well-loved classics alongside niche, emerging categories like orange wines or amphora-aged reds. In fact, orange wine sales in on-trade establishments grew by 14% in 2024, signaling a burgeoning demand for esoteric styles.

Additionally, experiential elements such as food-and-wine pairing dinners, vineyard collaborations, and immersive storytelling around wine sourcing have become critical in enhancing consumer engagement. Sommeliers are uniquely positioned to elevate these experiences, drawing on their expertise to weave narratives that connect wine to culture, history, and terroir.

Source: NZ Wine

Sustainability remains a top priority for both consumers and industry professionals. The 2025 report notes that over 62% of global wine consumers consider environmental impact when choosing wine, up from 54% in 2023. For the on-trade, this trend presents both opportunities and challenges. Venues are increasingly expected to offer wines that align with sustainable values, whether through organic certification, biodynamic practices, or low-intervention winemaking.

For sommeliers, this trend underscores the importance of understanding sustainable certifications and being able to communicate these practices effectively to guests. However, the report also highlights a growing consumer skepticism regarding "greenwashing"—the practice of making exaggerated or misleading claims about environmental sustainability. Sommeliers and beverage directors need to ensure the integrity of their wine programs by sourcing from producers with transparent, verifiable practices.

In practical terms, this might mean collaborating more closely with smaller, independent wineries that prioritize sustainable production methods. As one sommelier interviewed for the report noted, “The guests who ask about sustainability aren’t just looking for buzzwords—they want to know the story behind the bottle, from vineyard to table.”

The non-alcoholic and low-alcoholic wine category has expanded rapidly, with the report citing a 31% growth in global sales over the past year. This growth is driven by younger consumers, particularly Millennials and Gen Z, who are increasingly mindful of health and wellness. Sommeliers are tasked with integrating these options into wine programs in a way that feels intentional and inclusive, rather than as an afterthought.

Offering non-alcoholic pairings alongside traditional wine flights, for example, can enhance the dining experience for guests who abstain from alcohol. Similarly, the report suggests that venues should reimagine how these products are presented—on a curated section of the wine list rather than relegated to a “mocktail” menu.

Producers are also responding to this demand with improved quality and sophistication in their non-alcoholic offerings, such as de-alcoholized sparkling wines that retain complexity and structure. For sommeliers, understanding these products and confidently recommending them is becoming a valuable skill in the evolving hospitality landscape.

Economic factors, particularly inflation, continue to influence consumer behavior in the on-trade. While fine dining establishments may see less price sensitivity among their clientele, casual and mid-tier venues are feeling the pinch. The 2025 report highlights that 46% of consumers are more likely to opt for mid-priced wines compared to the pre-pandemic period, reflecting a cautious approach to spending.

Sommeliers and beverage directors can navigate this trend by focusing on value-driven selections. This doesn’t necessarily mean offering the cheapest options but rather wines that overdeliver in quality relative to their price point. Emerging regions such as Greece, Portugal, and parts of Eastern Europe are highlighted in the report as sources of high-quality, affordable wines that appeal to budget-conscious consumers.

Another strategy is to rethink by-the-glass offerings. Offering premium wines in smaller pours or flight formats allows guests to indulge in higher-quality selections without committing to the price of a full bottle. According to the report, 73% of sommeliers surveyed said they’ve seen increased interest in these options, particularly among younger guests.

Image Source: Freepik

Technology continues to reshape the wine industry, with applications ranging from supply chain management to guest engagement. For the on-trade, digital wine lists and QR code-based menus are now commonplace, but the report suggests that the next wave of innovation lies in personalization.

Some venues are experimenting with AI-driven wine recommendations that tailor suggestions to individual preferences, drawing on algorithms that analyze previous orders or taste preferences. Sommeliers remain critical to the success of these tools, bridging the gap between data-driven insights and the human touch that makes wine service memorable.

Social media and e-commerce platforms are also highlighted as key channels for driving consumer engagement. Sommeliers are increasingly leveraging their personal brands on platforms like Instagram and TikTok, sharing educational content that demystifies wine and builds trust with a broader audience.

Perhaps the most striking takeaway from the 2025 report is the continued evolution of the sommelier’s role. Beyond curating wine lists and recommending pairings, sommeliers are now seen as educators, advocates, and storytellers. This expanded role requires a deep knowledge of global wine trends, as well as the ability to communicate that knowledge effectively to diverse audiences.

Investing in education remains a priority for sommeliers who want to stay competitive in the field. Certifications such as those offered by the Court of Master Sommeliers, Wine & Spirit Education Trust (WSET), or alternative programs emphasizing equity and accessibility, are increasingly valuable in building credibility and expertise.

The report also underscores the importance of cultural competence in wine education. As the industry becomes more diverse, sommeliers must be prepared to engage with a wide range of perspectives and traditions. This might mean exploring indigenous grape varieties, understanding the historical contexts of wine regions, or addressing issues of inclusion and representation within the industry.

[[relatedPurchasesItems-61]]

The 2025 Wine Industry Report paints a picture of an industry in transition. For the on-trade and sommeliers, success will depend on a willingness to adapt to new consumer demands, embrace sustainability, and leverage technology without losing sight of the human connections that make wine so compelling.

Sommeliers, in particular, have an opportunity to lead this evolution. By championing value-driven selections, integrating innovative products, and serving as educators and storytellers, they can enhance the dining experience while staying ahead of industry trends. The future of wine in the on-trade is dynamic, and those who embrace change with creativity and expertise are well-positioned to thrive.

Also Read:

Trump’s Re-election: What It Could Mean for the US Wine Industry and On-Premise Trade

Wine Pricing: Strategy, Profitability and Adjustments

Understanding Common Wine Additives: A Guide for Sommeliers