Educating Sommeliers Worldwide.

By Beverage Trade Network

For small- to medium-sized wineries, exporting is a mixed bag and raises many questions. Will there be profits from exporting or is it better to stick with domestic sales? According to the recent BMO Wine Report, opportunities exist for US wineries to export. Currently, 29% of all wineries sell to export markets “and many of those planned to increase that trade this year.”

In an era when the San Francisco Chronicle can publish an in-depth article entitled “California wine is in serious trouble,” and industry consulting firm Gomberg Fredrikson says that wine consumption fell 8.7% in 2023, exporting may appear like an enviable solution for many wineries. The BMO report’s authors noted that the US three-tiered system actually may make it more complicated to sell across state than international lines.

What are the risks and rewards involved in exporting, and how can a small winery pinpoint profitable markets abroad? What kind of marketing and branding will be effective in foreign lands? Are the international distributors that will ease market access? Can a small or medium winery target market segments, such as the generally profitable and influential on-premise trade?

I spoke with several experts about the rewards and risks of exporting, including Rob McMillan, head of Silicon Valley Bank’s wine division and author of its highly-respected annual Wine Industry Report. He explained that US wine exports have historically been low because, first, of the historical size and growth of the US market, which absorbed most domestic production as well as imported wine. Second, he says, “In the past, we never had an excess [of wine] to deal with, so maybe that will change.”

Indeed, for the past two years, the USDA and the Wine Institute have been encouraging and facilitating exports, obviously in response to concerns about slumping domestic demand. In both 2022 and 2023, the Institute hosted the Global Buyer’s Marketplace (GBM), which brought in buyers from over 30 countries and 200+ California vintners.

GBM forms a key component of a ten-year strategy to increase US wine exports to more than $2.5 billion. The Wine Institute says, “Over the past two years, U.S. wine exports experienced 11% growth in value, totaling $1.46 billion in annual revenue. California, with the fifth-largest economy in the world,” it says, “contributes 95% to U.S. wine exports, and is the world’s fourth-largest wine producer.”

Markets represented at GBM included those in Eastern Europe, South and Southeast Asia, and even Oman. California Department of Food and Agriculture Secretary Karen Ross observed, “We have seen significant growth in California wine exports over the past two years and we are optimistic that important gatherings like GBM will help bring even more California wine to new markets overseas.”

Rob McMillan, however, points me to a legacy problem. “In many [foreign] countries, the exports that have been successful have come from larger wine companies shipping lower quality wine.” And, yes, the GBM included large wine companies: DNA Vineyards, The Wine Group, Franzia, and Bronco Wine Company. Wine giant GALLO is the largest US wine exporter. To give another example, Bronco controls 40,000 acres of vineyards making it the largest vineyard owner in California. “We export about 300,000 cases in glass and about 8 million in bulk,” Jim Carter of Bronco told reporter Pam Strayer at the GBM.

So, how is a small winery to compete with these giants and simultaneously earn a brand reputation for premium wines? Rob confirms this is an issue: “The end consequence [of larger exporters dominating exports] is US wine has mixed reviews in those places, so that will require brand building to successfully export.”

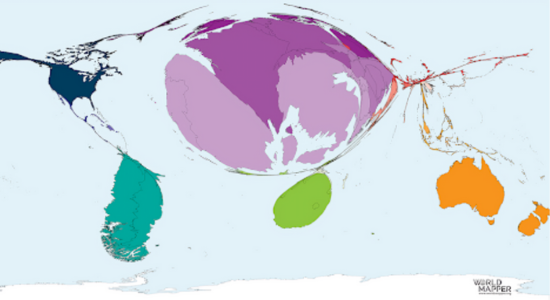

Source: World Mapper

Branding is crucial for small and medium wineries aiming to profitably export their products. As wine industry think tank ARENI Global recently pointed out, even in prestigious export platforms like La Place de Bordeaux, the onus lies on the winery to effectively brand its name and its products. In the highly competitive global wine market, effective branding helps differentiate a winery's offerings, build a loyal customer base, and justify premium pricing.

Effective branding must make a new winery entering a foreign market stand out from the competition. Unique branding elements such as a memorable logo, distinctive packaging, and a compelling brand story can attract the attention of international buyers and consumers.

A strong brand will then foster trust and loyalty among consumers. When buyers recognize and trust a brand, they are more likely to make repeat purchases and recommend the wine to others. This is particularly important in export markets where consumers may be unfamiliar with lesser-known wineries. Effective branding also allows wineries to command higher prices for their products. A well-established brand can position its wines as premium or luxury products, appealing to consumers willing to pay more for perceived quality and exclusivity.

But remember, as Rob McMillan tells me, “the US has a strong currency - meaning imports to the US have a currency advantage, and exports from the US are more expensive in those countries.” Rob advises: “You have to put some thought into your pricing strategies. You shouldn't expose your bottle price to fluctuate on currency moves. That means sometimes you'll have a better margin, and other times not unless you are hedging your exports with your bank.”

In addition, wineries wishing to export must (a) understand the tariff situation in their target market and (b) examine competition in that market. Andrea Consuegra, Chief of Staff at regional specialist distributor WEBB Banks, tells me that “locally produced spirits and beer brands generally dominate consumption across the [circum-Caribbean] region, benefiting from tariff protection, while many governments levy substantial taxes on imported wine and spirits - some reaching up to 120%.” WEBB Banks focuses on Central America and the Caribbean, which have many diverse national markets. Some countries have free trade agreements with the US and EU, others do not. From India, Sonal Holland MW, also emphasized to me that high taxes are a problem for wine market expansion there.

A useful research tool is the International Trade Center’s (ITC) Trade Map tool (trademap.org). For instance, if we look up category 2204, “wine of fresh grapes,” and select India, it will show us import figures for last year and trends for both volume and value of imports. In this case, India’s tariff on wine is a whopping 150%. Compare that to Panama, where US and EU wines pay a bit over 14%, a bit less for wines entering from Chile, Argentina, and Uruguay.

When I interviewed Sonal Holland MW last year regarding India as a market, she said India was not understood by Western wine companies. “International wine producers haven’t traveled to India enough, and culturally they don’t understand it.” Precisely understanding the market you intend to export to is critical. “They keep trying to draw parallels with China,” Holland said. “A lot has changed in the past ten years. Consumption of domestic wine has really taken off.” She spoke about rising disposable income, including “growth of 15% a year over the past ten years.” There has been increased exposure to Western lifestyles, and Indians are “very well-traveled.” “They encounter and consume their first glass of wine” and return home wanting to try more in India.

Exporting also means you must work with other companies. “If you want to export,” says Rob McMillan, “you should feel confident your wine will have a market in the country, and the companies you deal with are reputable.” That is why events like GBM are so useful. Honore Comfort told Pam Strayer at GBM: “The California wineries that are engaged and involved in export, they work with their importers and their buyers, to make the pricing work. It's about the value. And there are customers up and down the price scale.”

Indeed, partners like WEBB Banks can be indispensable. Andrea Consuegra explains: “We see ourselves as an integral part of our supplier partners' operations, assuming full responsibility for managing the business in the region and overseeing relationships with our in-market wholesalers. Our services are extensive, including the design of route-to-market strategies and marketing programs, regular business reviews and reporting, and compliance support, among others.” She adds that her firm also manages all credit risk, a critical factor for wineries navigating in a volatile region. “Our ability to deliver these services effectively is empowered by our team, based both in the US and in the markets, who possess unparalleled knowledge of and access to the local markets.”

Image Source: WEBB Banks

Do not forget that wineries can pursue specific export market segments, like the on-trade, even when those clients are far away. Rob McMillan tells me that “many high-end wineries have done work at the account level to get their wine in better hotel restaurants in foreign countries where US consumers travel. They represent a small part of their total sales and in some cases are in countries an owner might like to travel, making the selling expense a tax deduction.” Indeed, international wine competitions focused on the on-trade can help a new import brand to gain instant recognition and a solid reputation. This can include those “better hotel restaurants” that Rob refers to.

Consuegra adds: “Engaging with consumers as they travel is an excellent opportunity for brands to connect with their target customers because when people enjoy a product on vacation, they are likely to seek it out when they return home. Our partners recognize the complexity of operating in the region and rely on our team's experience and presence to grow in these channels.”

Emerging wine markets that are not traditionally wine-drinking countries increasingly show potential, so it’s important to think out of the box.

In 2012, Larry Lockshin and Armando Maria Corsi published a wine industry literature survey in the journal Wine Economics and Policy. The concluded twelve years ago: “We know Western European markets are declining, while China, Brazil, Russia, and to a lesser extent, India and other developing markets represent opportunities for all wine producers around the world. The preliminary research approach for these countries should be based on a replication of the studies conducted in mature markets to observe similarities and differences between them and emerging markets.”

Likewise, Natalia Velikova, Olga Murova, and Tim H. Dodd wrote in 2013 in the same journal: “The increased globalization of the industry” requires “in-depth examinations of emerging wine markets. Particularly, the need to understand crucial dimensions of the operating environment, the competitive context, and the consumer base in emerging markets becomes evident.” They found that non-wine production regions of the world, “even though they do not produce wine of their own,” could “comprise lucrative markets for export.”

So, we’ve known for a long while that potentially lucrative markets for wine exports may lie outside of the areas we traditionally think of. The industry still has some catching up to do in this regard, particularly considering apparent downturns in wine consumption and demand. Consuegra, for example, points out that “despite rising economic constraints and increased costs of living causing consumers to trade down on price, there is still a significant opportunity to raise awareness of wine and foster local engagement with brands. This is particularly evident in Central America, especially in Panama and Costa Rica, where local interest in wine is thriving alongside increased exposure and education.” India and Oman are other examples. According to the ITC Trade Map, Oman experienced 12% growth in the value of wine imported, year-on-year, between 2022 and 2023. That amount was small, a little over $3 million, but the country’s presence at GBM shows that there is active interest. Growth is Growth.

Header image: Global Buyers Marketplace; source Wine Institute